mi property tax rates

For example if the citys millage rate is 10 mills property taxes on a home with a taxable value. Treasury Income Tax Office.

Property Tax Rates Skyrocket In Illinois 2nd Highest In U S

Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County.

. Delta Township had a total taxable value of 1468853584 in 2018 of which 53 is residential property. Winter Millage Rates and Breakdown. The Property Tax Calculator is designed to provide tax estimates by multiplying the property values entered and the most current millage rates available.

Detroit Taxpayer Service Center Coleman A. Ad Enter Any Address Receive a Comprehensive Property Report. Please click on the appropriate link below for the annual property tax millage rate.

Beginning March 1 2023 all unpaid taxes are considered delinquent and are payable with additional penalties to Oakland County Treasurer. Property Tax Lansing MI - Official Website. Making Changes to Property Tax Information.

Property owners can calculate their tax bill by multiplying their taxable value by the millage rate. Delta Township Eaton Count. See Results in Minutes.

Winter Taxes 2021 winter taxes are payable from December 1 through February 14 2022 without penalty. Departments O through Z. An appraiser from the countys office establishes your propertys market value.

The calculator can provide. The average effective property tax rate in Macomb County is 168. Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment.

84 rows When comparing Michigan real property tax rates its helpful to review effective tax rates which is the annual amount paid as a percentage of the home value. 84 rows To find detailed property tax statistics for any county in Michigan click the countys. The Millage Rate database and.

Michigan property tax rate info by United Paramount Tax Group Compare lowest highest and cheapest Michigan Personal property taxes. Discover the Registered Owner Estimated Land Value Mortgage Information. If you have read and agree to the above comments and.

The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. Basic assessment and tax information of taxable properties that are located within the City of Warren is available to everyone. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313.

Counties in Michigan collect an average of 162 of a propertys assesed fair. Young Municipal Center 2 Woodward Avenue - Suite 130 Detroit MI 48226 313-224-3560 800 am - 400 pm City of Detroit CFO. For more details about the property tax.

Send your check money order to. We are open Monday through Friday from 830 am to 430 pm. Simply enter the SEV for future owners or the Taxable Value.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Total taxable value per. That updated value is then multiplied times a combined levy from all taxing entities together to set tax due.

The following is a list of property tax millage rates by year for properties residing in the City of Walker. On February 15 2023 penalty of 3 will be added. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

The Ultimate Guide To Michigan Property Tax Easyknock

Where Are Property Tax Rates Highest And Lowest In Michigan Mlive Com

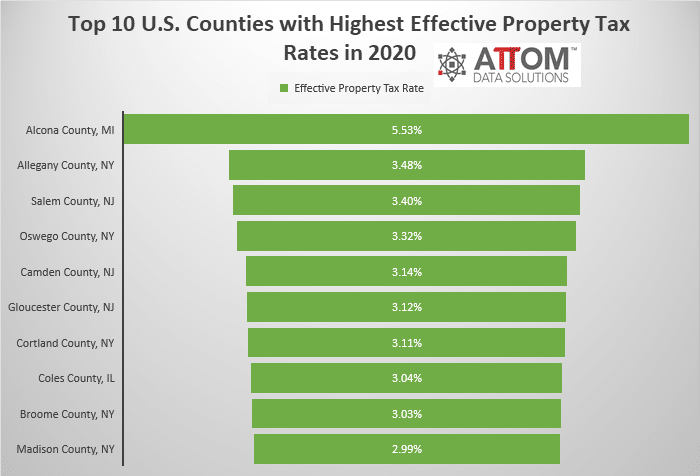

Top 10 U S Counties With The Greatest Effective Property Tax Rates Attom

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

Michigan Family Law Support January 2019 2019 Federal Income Tax Rates Brackets Etc And 2019 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Hawaii Has The Lowest Property Tax Rate In The U S Locations

Taxes Pittsfield Charter Township Mi Official Website

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

What Michigan Communities Had The Highest Property Tax Rates In 2019 Here S The List Mlive Com

2020 Michigan County Allocated Tax Rates Center For Local Government Finance Policy

Minnesota Takeaways From Our Latest 50 State Property Tax Comparison Study

Joco Cities To Hold Hearings On Proposed Property Tax Rates For Next Year See Your City S Rate

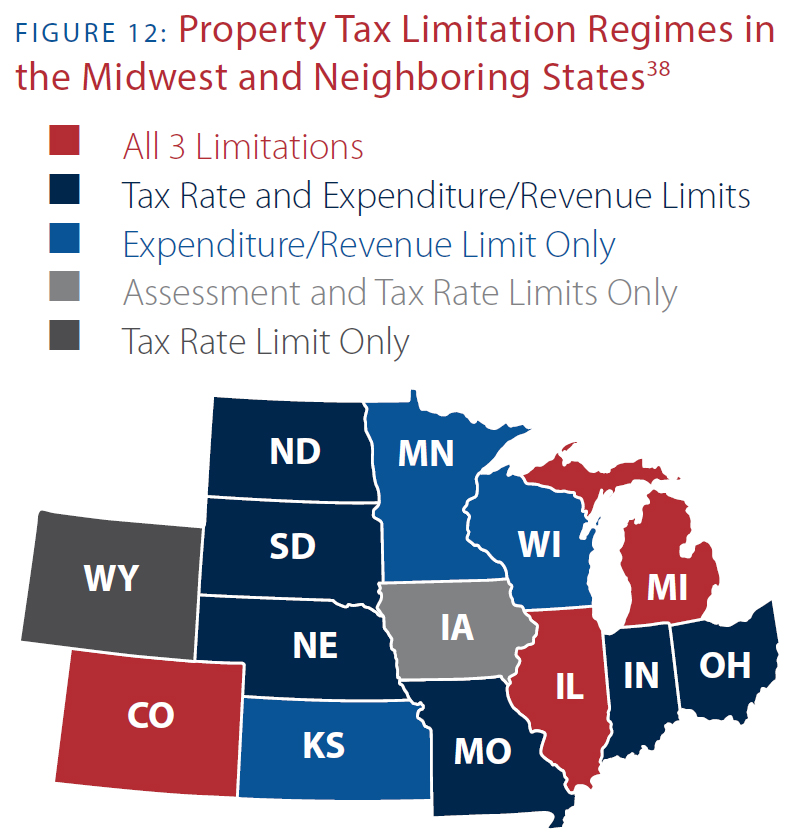

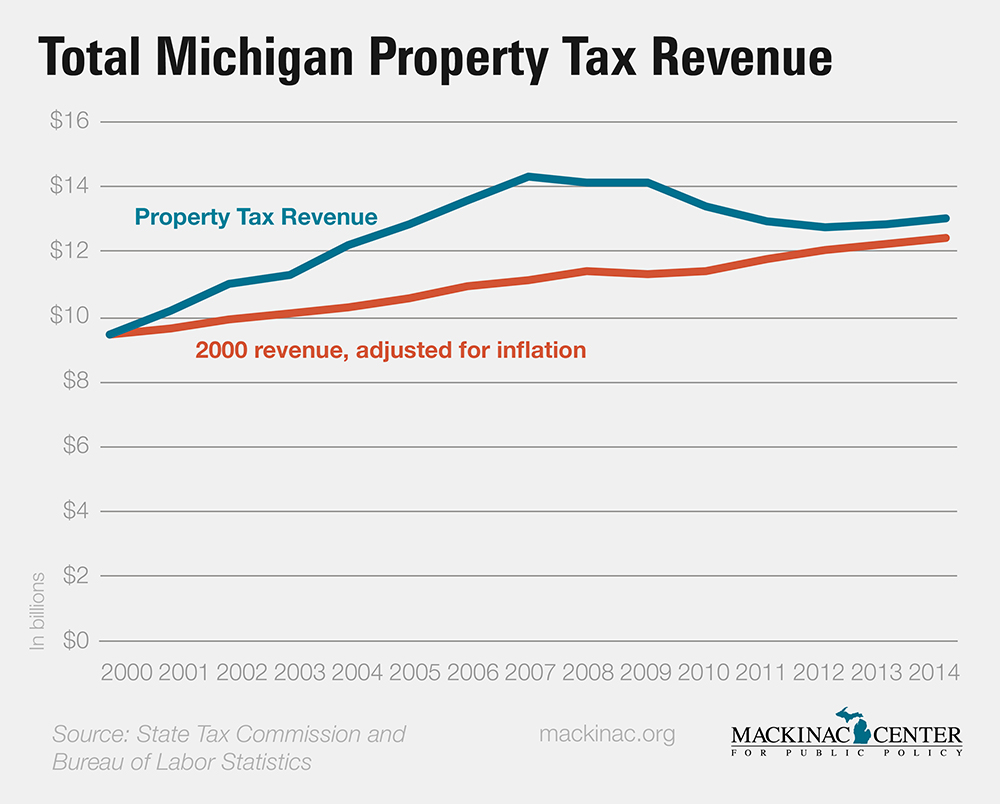

Michigan Property Values Citizens Research Council Of Michigan

Michigan Property Values Citizens Research Council Of Michigan

States With The Highest Lowest Tax Rates

Top 10 U S Counties With Highest Effective Property Tax Rates Attom